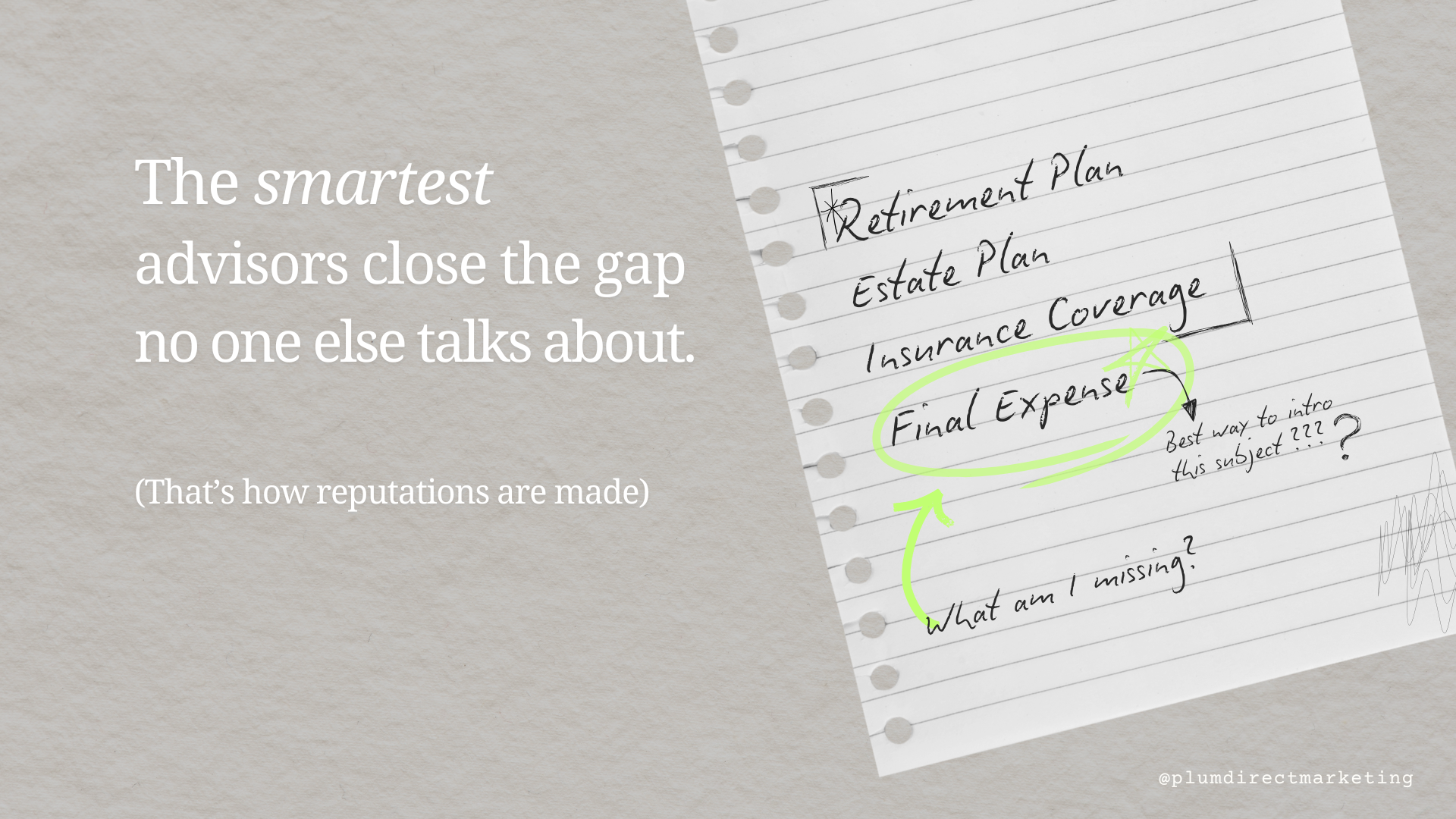

Most financial planners pride themselves on being ready for anything—until a client dies, and their family is left scrambling to pay for a $10,000 funeral and medical bills nobody expected.

It’s not just a personal tragedy. It’s a professional risk.

Final expense insurance isn’t just another line item. It’s the trust bridge between your careful planning and your client’s real-world legacy.

At Plum Direct Marketing, we help financial advisors not just understand final expense coverage—but master final expense advertising to reach senior clients without fear tactics, awkward conversations, or missed opportunities.

In this guide, you’ll learn why final expense insurance belongs in every senior client’s plan—and how powerful, well-timed marketing can help you strengthen relationships, close coverage gaps, and grow your business.

Why Final Expense Insurance Matters More Than You Think

Most advisors focus on retirement projections and estate transfers.

But the final 30 days of life—where families face thousands in sudden costs—often gets missed.

Final expense insurance exists to close this dangerous, emotional gap.

Why it matters:

- Life insurance isn’t liquid. Traditional payouts take weeks or months.

- Funeral costs are massive. The average U.S. funeral costs $7,800+ (NFDA).

- Medical debt surprises families. Seniors often leave behind $2,000–$10,000 in final bills (KFF).

- Assets are locked. Probate delays tie up estate funds when they’re needed most.

Smart financial planners market final expense insurance as a liquidity tool— one that protects client families immediately, when they need it most.

At Plum Direct Marketing, our campaigns help advisors start these conversations early, framing final expense coverage as an act of financial compassion, not just another product pitch.

Common Final Expense Myths That Hurt Your Clients (and Your Brand)

Your clients believe a lot of things that simply aren’t true.

If you don’t address these myths head-on, you risk letting bad assumptions sabotage your planning—and your professional credibility.

Top myths we help advisors debunk:

- “Medicare will pay.”

Reality: Medicare covers almost nothing for funeral or burial costs. Period. - “Life insurance is enough.”

Reality: Traditional policies often delay payout, and term policies may expire when seniors need them most. - “They have savings.”

Reality: Most families’ wealth is locked in retirement accounts, trusts, or probate—none of which cut a check in 48 hours. - “Final expense is only for low-income clients.”

Reality: Final expense bridges liquidity gaps for all wealth levels—especially important for families with significant but non-liquid assets.

We help advisors turn myth-busting into a powerful educational marketing strategy, using real-world client stories and simple infographics that move clients from skeptical to sold.

Common Final Expense Myths That Hurt Your Clients (and Your Brand)

How Smart Marketing Sells Final Expense Without Fear Tactics

Final Expense Marketing doesn’t require doom-and-gloom pressure to succeed.

You need strategic positioning, emotional intelligence, and channel mastery.

Here’s what we’ve learned at Plum:

Speak to Legacy, Not Loss

Marketing that focuses on protecting family dignity and legacy performs 35% better than marketing focused on costs.

Say: “Leave a lasting gift of peace.”

Not: “Avoid $10,000 debt.”

We design campaign messaging that speaks to pride, love, and family care—not fear or guilt.

Use the Right Channels for Senior Clients

Seniors trust traditional, tangible communication:

- Direct mail (high-response postcards and letters)

- Personalized, plain-text emails

- Educational event invitations (“Final Expense Planning Workshops”)

Direct mail response rates for seniors are 400% higher than social media ads, based on our final expense advertising benchmarks.

We build multi-channel marketing sequences that make final expense discussions feel natural, not pushy. Well-crafted final expense ads don’t just inform, they start trust-based conversations that lead to action.

Final Expense Marketing works best when it feels personal. That’s why our campaigns are built to reflect your voice, your clients, and your values, not a generic sales pitch.

Time It Right

Trigger life milestones to introduce final expense planning:

- Retirement or semi-retirement

- Downsizing

- Major health diagnoses

- Death of a spouse or loved one

Our event-triggered marketing outreach automates perfectly timed final expense discussions, keeping your pipeline warm without constant manual effort.

Best Practices for Introducing Final Expense to Senior Clients

Bringing up end-of-life expenses doesn’t have to feel awkward.

When done correctly, it builds trust, strengthens loyalty, and grows coverage ratios.

Smart strategies we recommend:

- Integrate it into annual review meetings alongside retirement income and estate planning.

- Use real examples (“Imagine needing $12,000 next week—where would it come from?”).

- Frame final expense as emotional protection, not financial sales.

- Provide simple visuals showing the timeline delays for traditional life insurance payouts.

We create client-ready marketing materials for our advisor partners—including conversation scripts, educational brochures, and ready-to-send email templates.

Final Expense Marketing Mistakes Financial Planners Should Avoid

Don’t let small mistakes blow up client trust. Here’s what to dodge:

- Waiting too long to bring it up (if you’re scrambling, you’re losing)

- Leading with fear or guilt messaging (old-school, ineffective, and trust-eroding)

- Treating it like an “add-on sale” instead of part of the core plan

At Plum, we train advisors to frame final expense as a value add—positioning you as the planner who thought of everything.

Why Financial Advisors Trust Plum with Final Expense Marketing

- Custom marketing campaigns tailored to your client base

- High-performing direct mail and digital sequences

- Expert consulting for positioning and emotional client conversations

- Proven final expense advertising strategies that drive real policy adoption

Want to see a campaign that boosted senior coverage rates by 30%? [Book a free strategy call with Plum here.]

Final Thoughts: Final Expense Insurance Isn’t About Fear—It’s About Finishing Strong

Clients trust you with their future.

Make sure you’re protecting their family’s present, too.

Partner with Plum Direct Marketing and bring final expense insurance into your practice the right way—smartly, ethically, and profitably.