TL;DR

You don’t need a viral following to become influential. You need consistency, clarity, and content that helps people make smarter financial decisions. That’s what builds trust, and trust is what drives new clients.

Influence in the financial planning world doesn’t come from being loud. It comes from being useful. The advisors who earn visibility online do one thing better than anyone else: they teach.

When people search for answers about investments, retirement, or wealth management, they’re not looking for entertainment. They’re looking for someone who makes complex topics clear. If that person is you, you’ve already won half the battle.

Here’s how to start building real influence—without pretending to be someone you’re not.

1. Build a Blog That Educates, Not Sells

Create a blog on your website and post consistently. Focus on the questions your clients actually ask:

- “How do I plan for retirement during inflation?”

- “What’s the difference between a Roth IRA and a traditional IRA?”

“When should I start estate planning?”

If writing isn’t your strength, hire a professional writer or marketing partner to help you maintain quality and consistency. Guest posting on other reputable sites is another smart move—it builds backlinks, visibility, and authority. The more value you share, the more credible your name becomes.

2. Use Social Media Strategically

You don’t need to post every day—you just need to post with purpose.

Share bite-sized insights, market updates, or simple tips that connect back to your expertise. Use platforms like LinkedIn to start conversations, not just to broadcast.

Ask questions, post polls, and comment on industry news. The goal isn’t to go viral; it’s to stay visible and relevant to your audience.

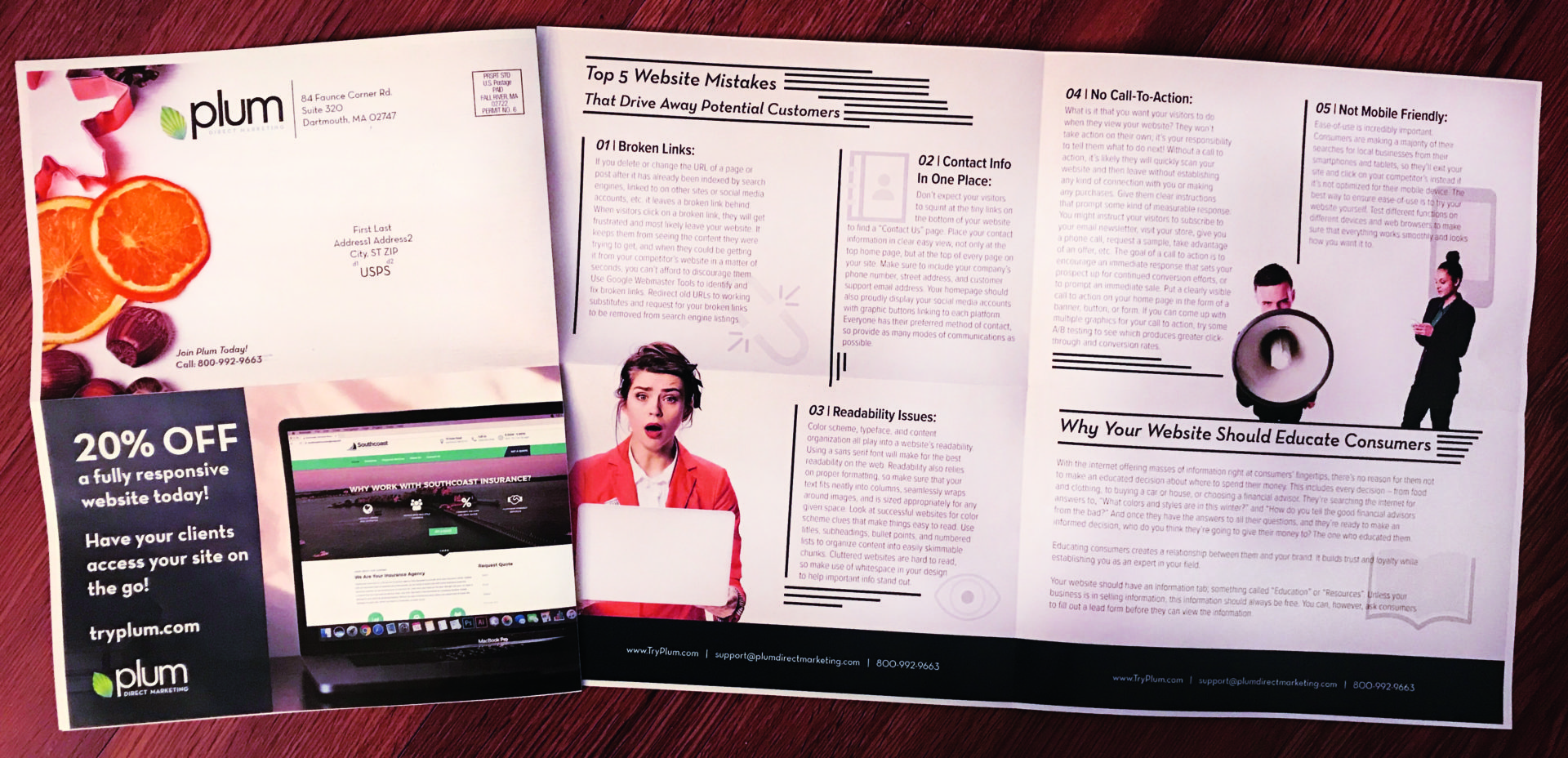

3. Stay Top-of-Mind With a Newsletter

A monthly or quarterly newsletter keeps you in front of clients and prospects without feeling pushy.

Deliver real value: tax reminders, market insights, or planning checklists. Whether digital or printed, a well-branded newsletter positions you as steady, professional, and worth listening to.

Bottom Line

Becoming an influencer in the financial planning industry isn’t about followers, it’s about trust.

When you consistently share content that educates, informs, and respects your audience’s time, you naturally attract higher-quality clients and longer-term relationships. Influence isn’t built overnight, it’s earned post by post, insight by insight.

If you’re ready to strengthen your presence and stand out in your market, contact us. We’ll help you turn your expertise into influence, with content that earns attention and builds credibility where it counts.

FAQs

How can financial advisors grow their influence online?

Start by sharing helpful, easy-to-understand financial advice on your website and social platforms. The more consistently you educate, the more likely people are to view you as a trusted expert.

What kind of content helps financial planners build credibility?

Educational posts, timely market updates, and clear explanations of complex financial concepts all help establish authority. Focus on clarity, not cleverness.

Do financial advisors need social media to become influencers?

Yes—but strategically. You don’t need to be everywhere. Choose one or two platforms (like LinkedIn and Facebook) and use them to spark conversation and demonstrate expertise.

How often should a financial advisor publish content?

Aim for consistency over volume. A well-written monthly blog or newsletter can do more for your credibility than daily posts that add no value.

What’s the best way to turn online influence into clients?

Offer content that naturally leads readers to your services. Include clear calls to action like “Schedule a free consultation” or “Download our retirement planning checklist.” When your content helps people, conversion follows naturally.